Regular readers of our notes will know we’ve been bearish equity markets since early 2022. However, a number of catalysts have emerged which could potentially turn market sentiment to bullish. In this article, we’ll explore the key drivers behind the market’s sudden resurgence over the past six months, and why we may just see the market higher – if highly volatile – by the end of 2023.

Catalyst 1 – Everyone was bearish going into the new year

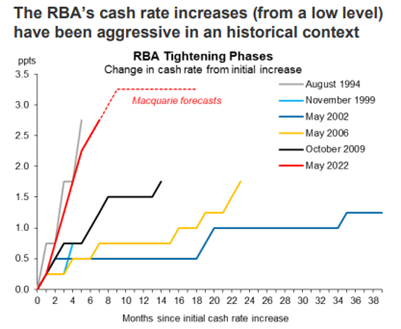

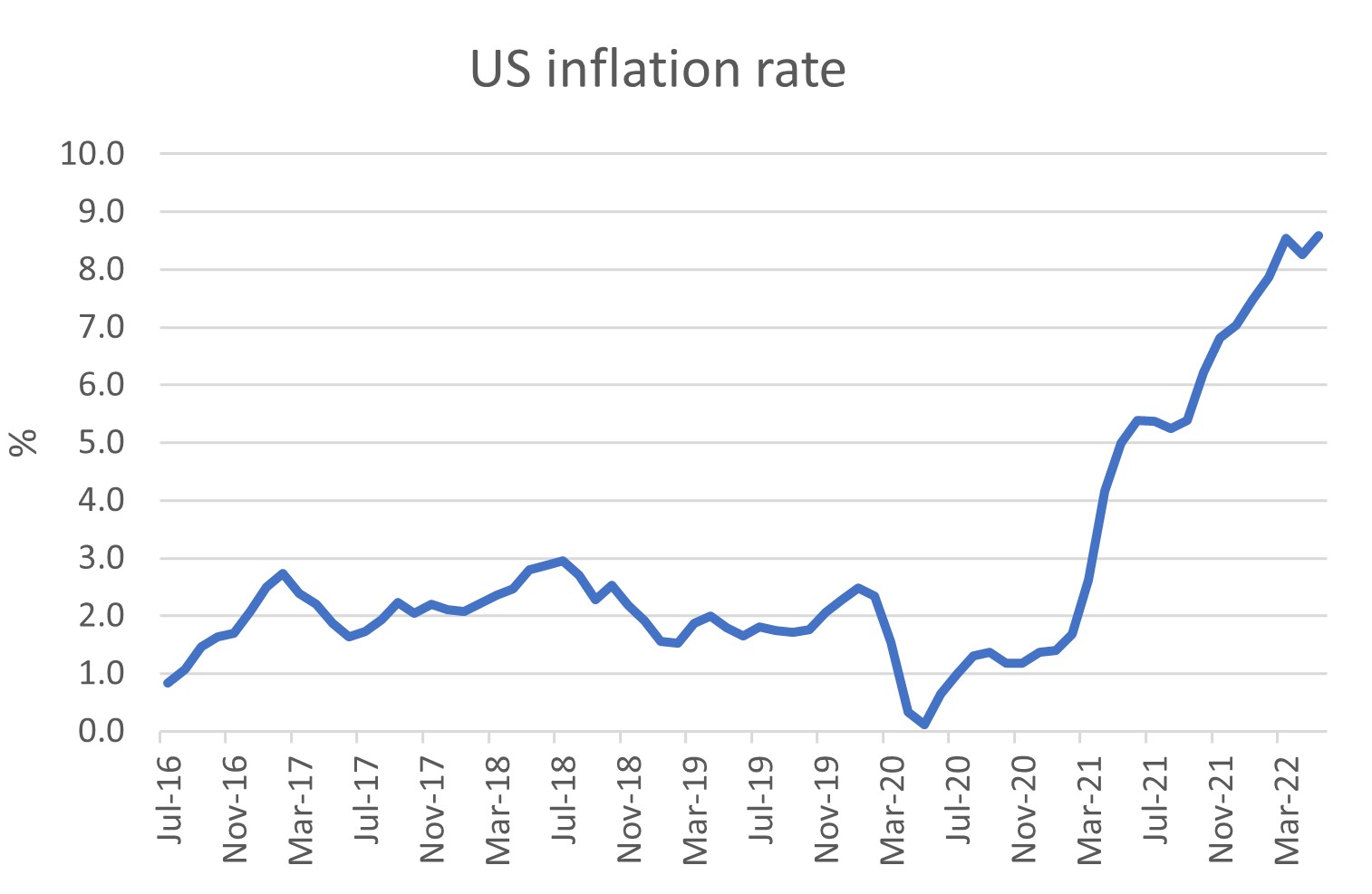

Investors are cautious, and for good reason. Markets have seen a rapid increase in interest rates to levels not seen since 2012 (and are forecast to go higher still) and consumers are heavily indebted. Corporate earnings remain challenged in 2023 after a resilient 2022. Margins are likely to be lower given widespread cost pressures.

All this is likely to manifest itself in weak earnings guidance during the February profit reporting season. Investors have noticed, and subsequently positioned themselves for a poor reporting season. This was highlighted in the options markets as well, with investors buying four times as many puts as calls on some recent trading days. The Fed has also continued to talk markets down post rate rises, with the media suggesting we should not fight the Fed.

With such constant messaging, no wonder the bears have been out in force.

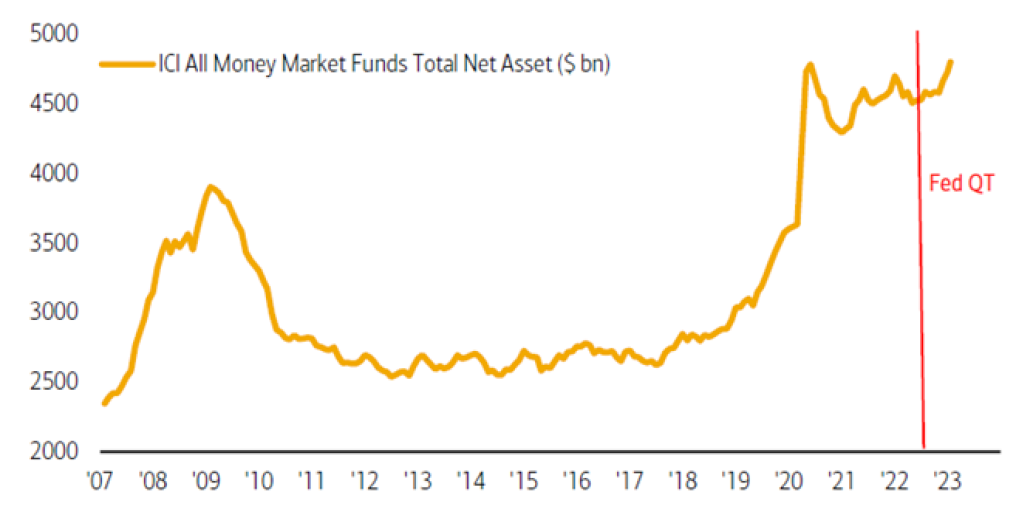

Towards the end of December, the US Emerging Portfolio Fund Research (EPFR) reported outflows of -US$41.9b from equities in one week – the highest ever recorded. Cash levels are near all-time highs.

So a weak reporting season appears to be consensus view, with the broad market already positioned for it.

However, history has shown time and time again that when all investors are sitting on one side of the boat, the opposite tends to occur. Already one large investment bank (Goldman Sachs) has changed its view, lowering the odds of a recession to 25% (versus the market at 70%). If more research houses follow, we may see an ongoing rally in the market.

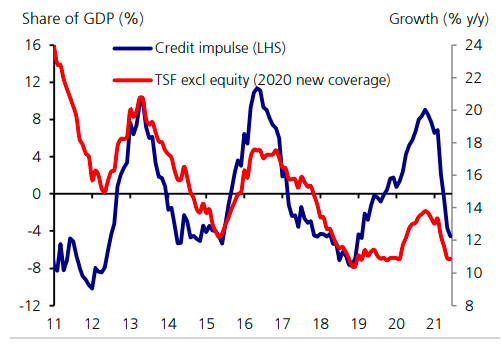

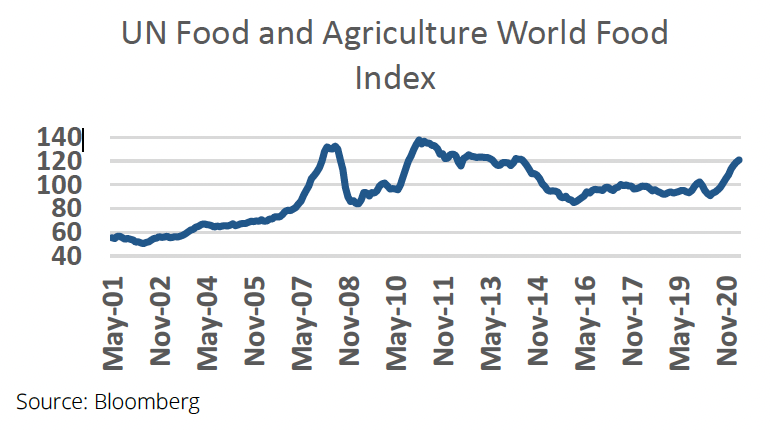

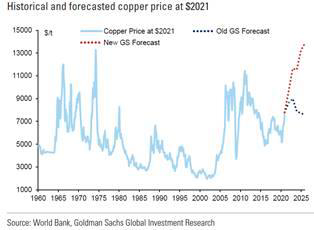

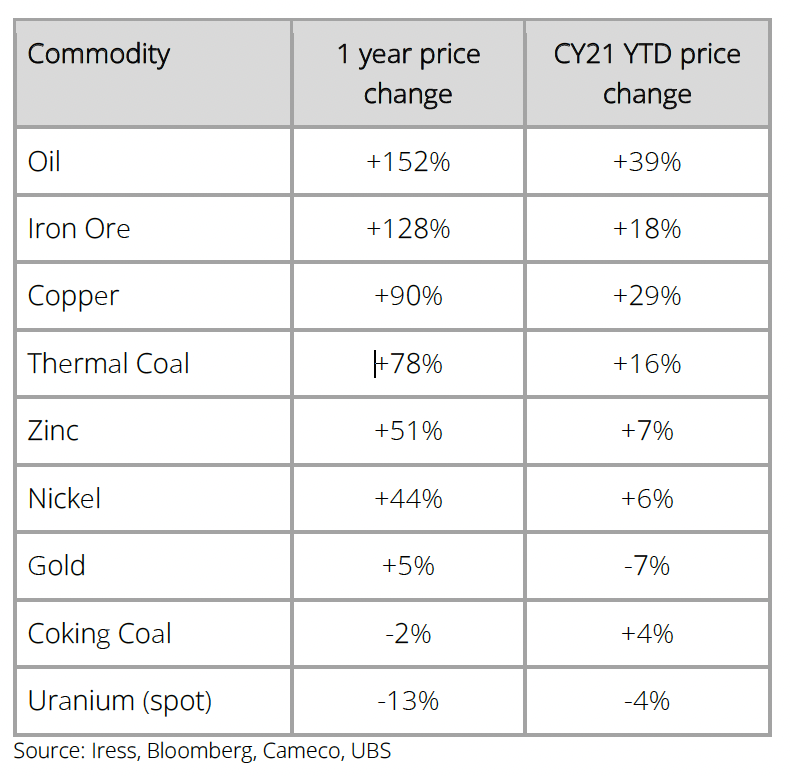

Catalyst 2 – China is reflating

Now China has got rid of its zero COVID policy and is reopening, the country will stimulate its economy in 2023. We expect good growth numbers as a result, which has multiple implications. If China’s GDP rises by 4-5% next year, it will likely be the strongest performance among the G-7. Commodity markets generally, but metals in particular have embarked on an upside run ever since China re-opened in December. Uranium, copper, precious metals and, of course, iron ore have all moved higher, pricing in potentially much better demand from China. We have China’s GDP moving higher, starting in Q2 and ending the year +5% with 2024 penciled in as a +4% GDP year.

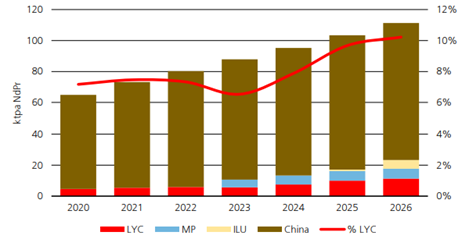

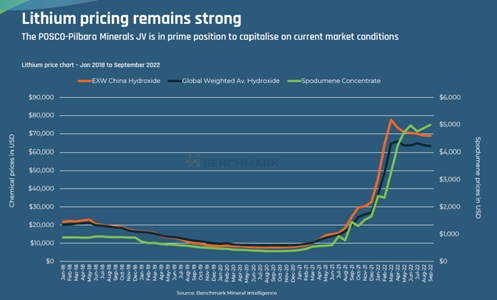

One stock benefiting from China’s reflation and on which we have high conviction is Mineral Resources (MIN). MIN produces lithium from its Mt Marion and Wodgina mines and Kemerton lithium hydroxide facility in Western Australia. It also has a highly regarded mining services business, operates its own smaller iron ore operations and has a fledgling energy business. The company has a number of growth projects underway including Wodgina train 3, the restructure of the MARBL JV with Albemarle, the Onslow iron ore development and the Norwest Energy acquisition. While the company is currently going through a period of elevated capex, we expect strong free cash flows to return from FY24. We value MIN at $110, with lithium ~50% of this, mining services ~44% and iron ore the remaining 6%.

Catalyst 3 – Is the Fed close to peak interest rates?

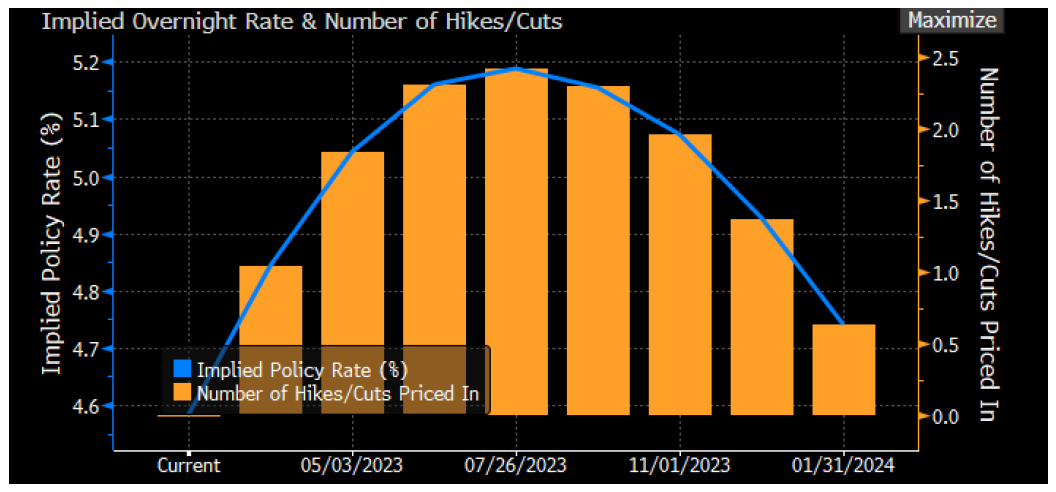

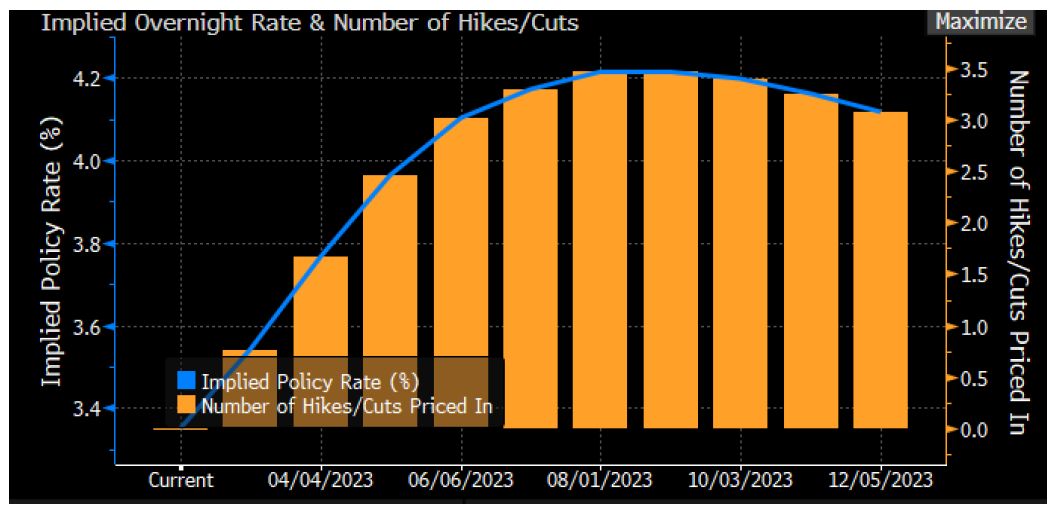

Historically the Fed tends to cut interest rates about 10 months after its last hike. As we know, the market tends to look six months ahead. True to form, the futures markets are predicting this very thing.

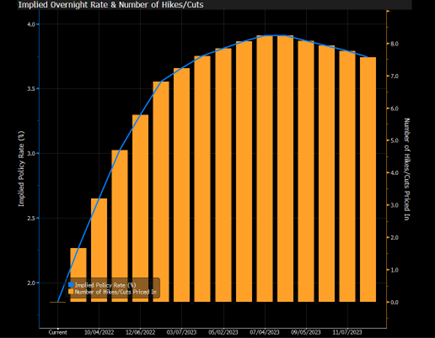

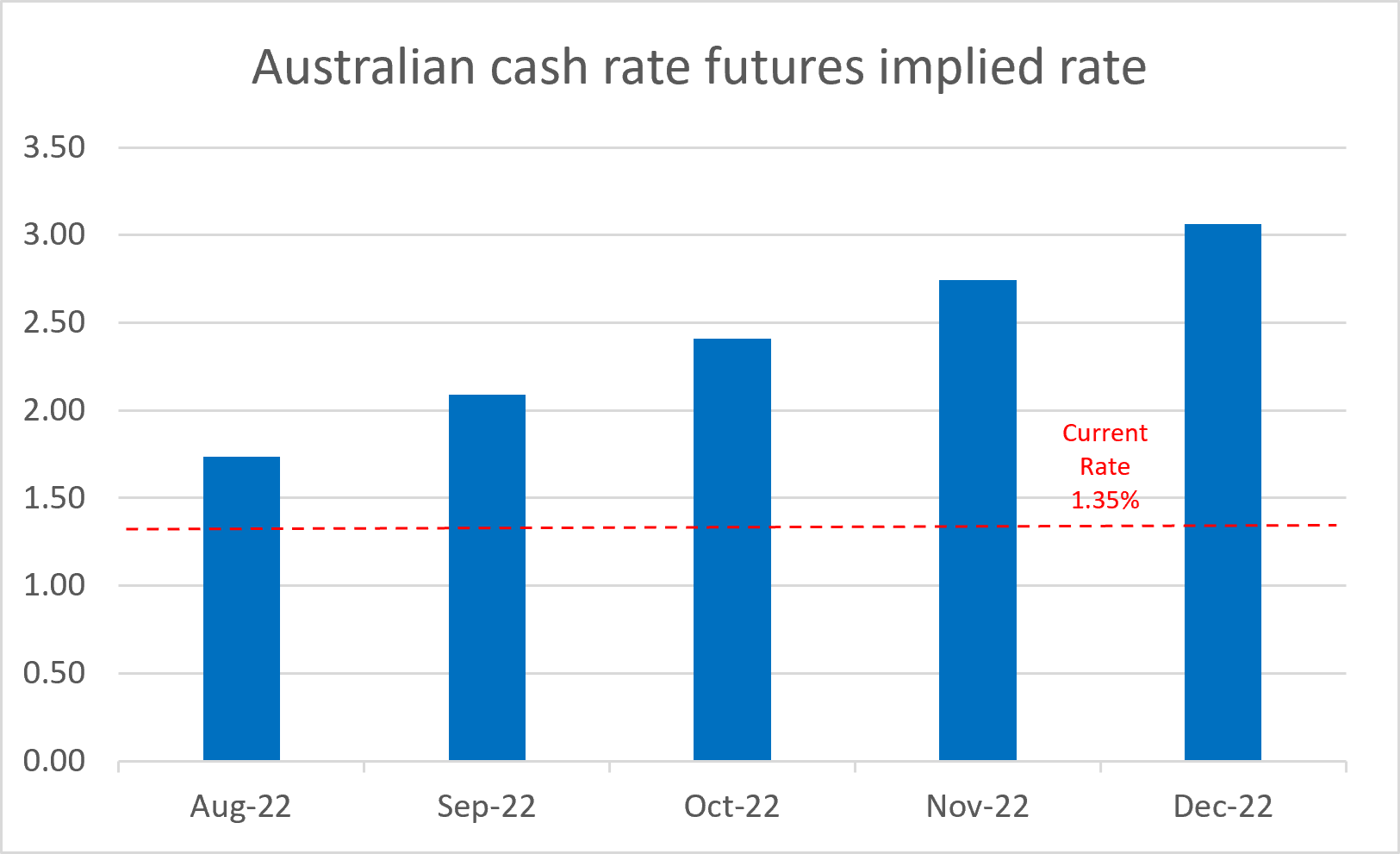

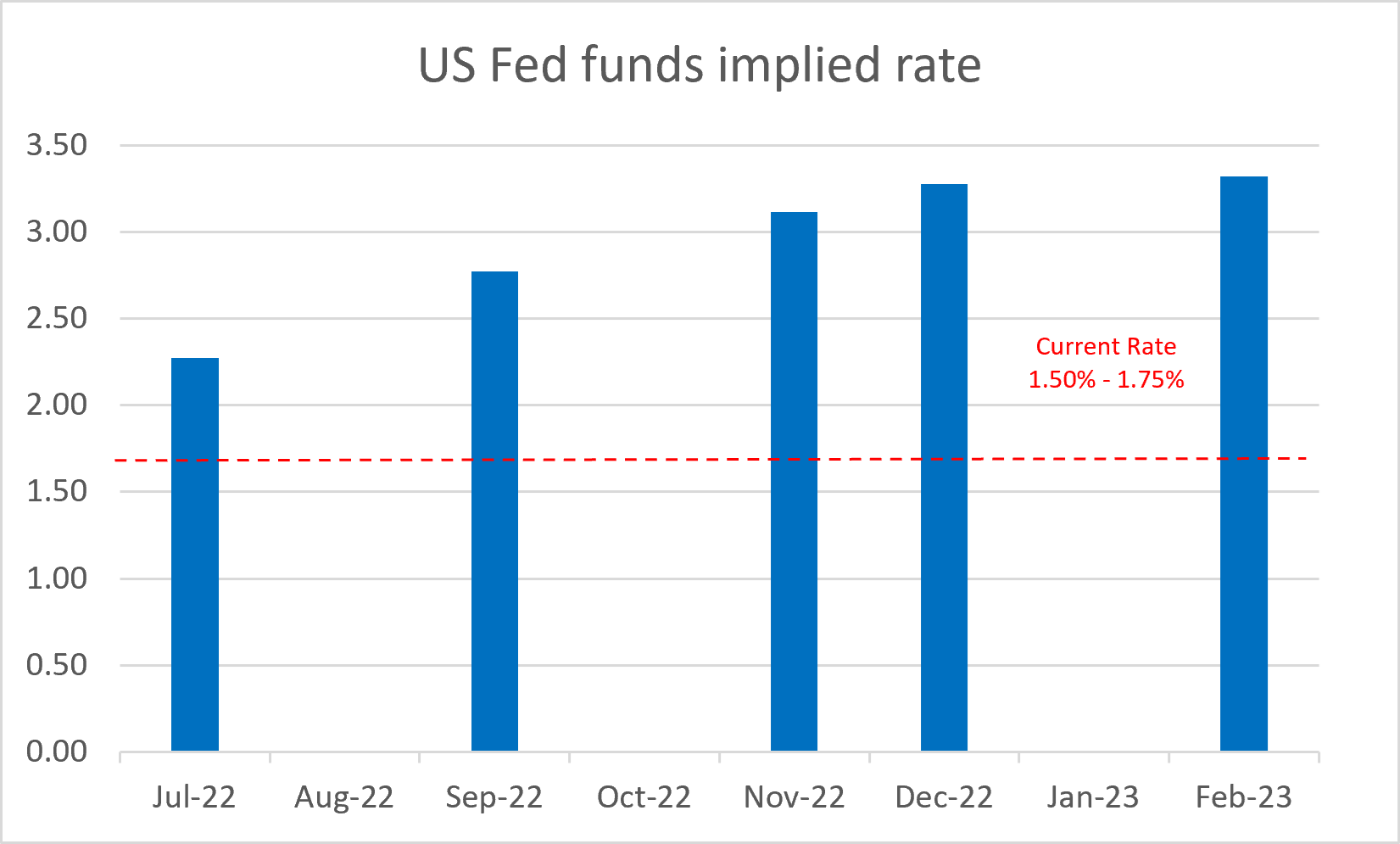

Is the rally in equities we have seen this year driven by markets anticipating a Fed pivot in late 2023? The US interest rate futures market is predicting peak interest rates in July with 77bps to go, Australia slightly later in September with 87bps to go. We also know that as global economies come out of this recessionary environment, stocks will explode higher and we will see some enormous rallies. It would be entirely logical for investors to jump the gun and get set in positions now.

US Futures Market

Australian Futures Market

Source: Bloomberg

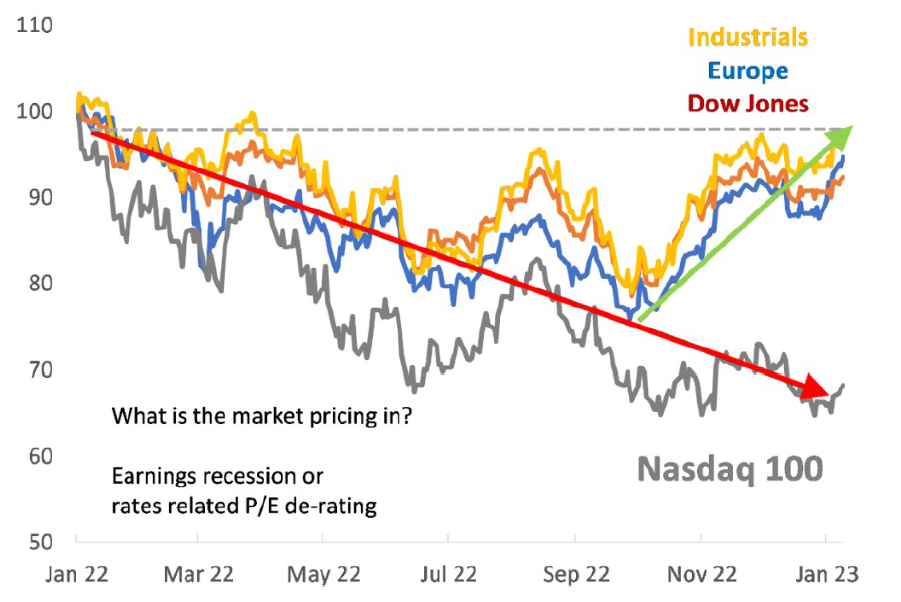

While some sectors are yet to de-rate, others (such as technology) have already had heavy falls. Although a large part of the fall was driven by multiple de-rating due to increased interest rates, we believe the risk/reward proposition is now much more attractive.

One stock we have added to the portfolio is Netwealth (NWL). While recent fund flows have been soft and the company is experiencing significant cost growth investing in the business, the key factors we look for in a stock remain present. The addressable market is large and growing and there is a significant opportunity to continue growing market share, with share of fund flows (~40%) significantly greater than NWL’s current market share of FUM (~6%). The business generates high margins (~45% EBITDA margin) and returns, and has exceptional earnings quality and a strong balance sheet ($99m cash, no debt). In addition, management remain significant shareholders in the business (>50%). The stock may not appear ‘cheap’, trading at a PER of 37x FY24e, but we believe the company will grow into this multiple given the potential for strong sales growth over an extended period of time.

Catalyst 4 – Technical depth and breadth

We don’t usually pay much regard to technical indicators. However, two recent ones bear mentioning.

The ‘Breakaway Momentum’ indicator calculates the number of advancers vs decliners on the NYSE for a 10 day period. If it breaches 1.97, a true breadth thrust has occurred, which often happens before the start of a new bull market. It has only happened 24 times since World War 2 and the 25th time occurred in early January. The median and mean gain for the NYSE 12 months post the trigger is 20%, with a 96% success rate.

The second key indicator is the 200 daily moving average. Remember, bear markets rarely trade above the 200 DMA for more than five days. If they do, it often means the bear market is over. Sure enough, the S&P 500 recently breached the 200 DMA and held this level for five days.

So the start of 2023 has confounded investors around the globe. If one steps back, 2023 – while volatile and facing many headwinds – might be the year to dare to dream. Perhaps, against all odds and widespread belief, we’ll finish the year in positive territory.

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.