As stocks have wobbled, investors have bemoaned having no place to hide – not even in gold. June alone saw the market fall a whopping 8.97%.

However, short positions across key sectors such as lossmaking, high multiple technology and consumer discretionary stocks seem to be strong contributors to relatively solid fund performance.

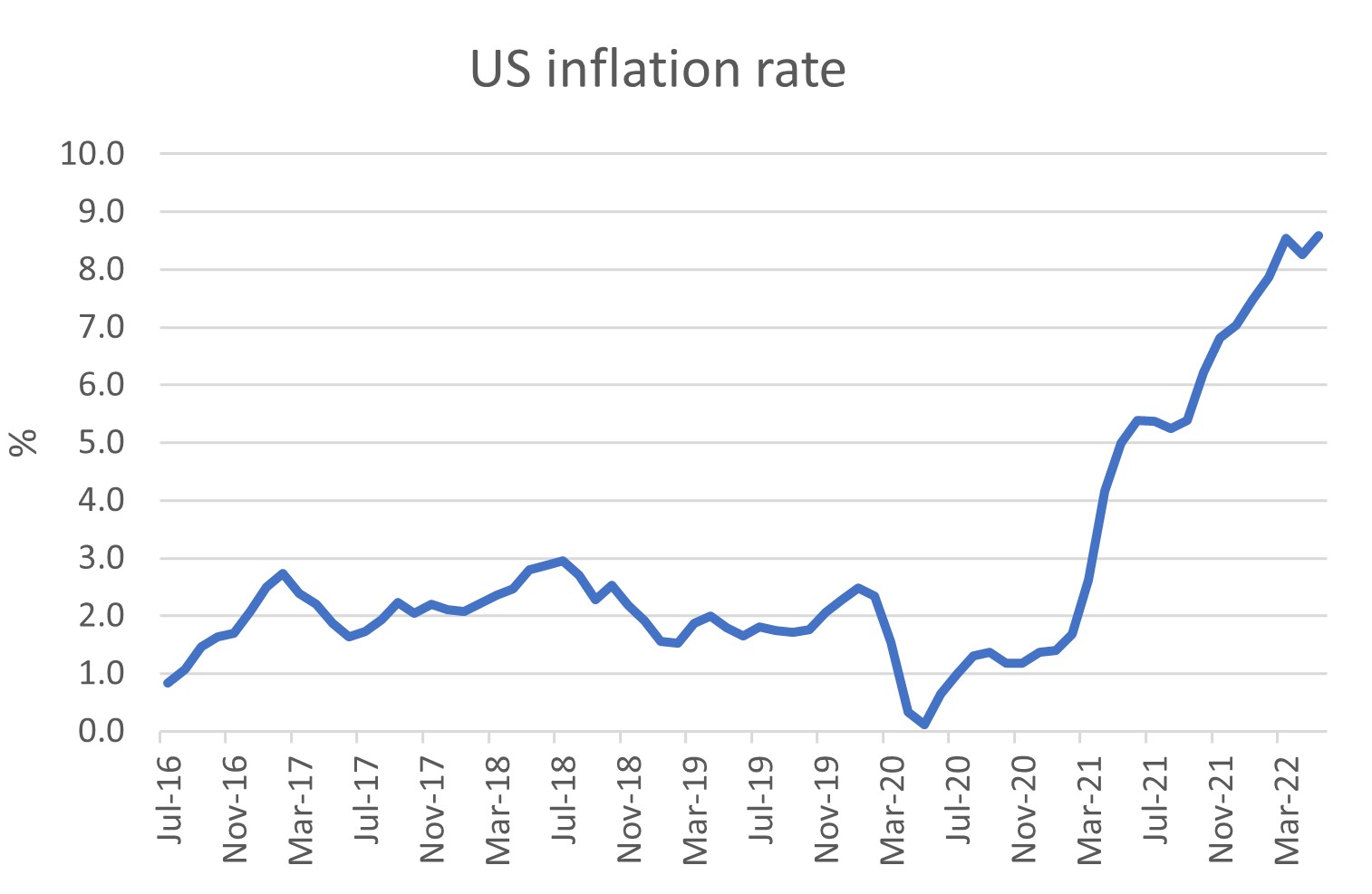

Inflation sticks

Meanwhile, the Australian CPI surged 5.1% for 12 months to 31 March this year, and the US CPI rose 8.6% for May year on year, potentially moving towards levels not seen since 1970- 1980. And while last year central banks and economists were calling for the inflation spike to be transitory, the pathway of inflation over the last 18 months has been anything but. Inflation tends to be stickier than imagined.

Source: Bloomberg

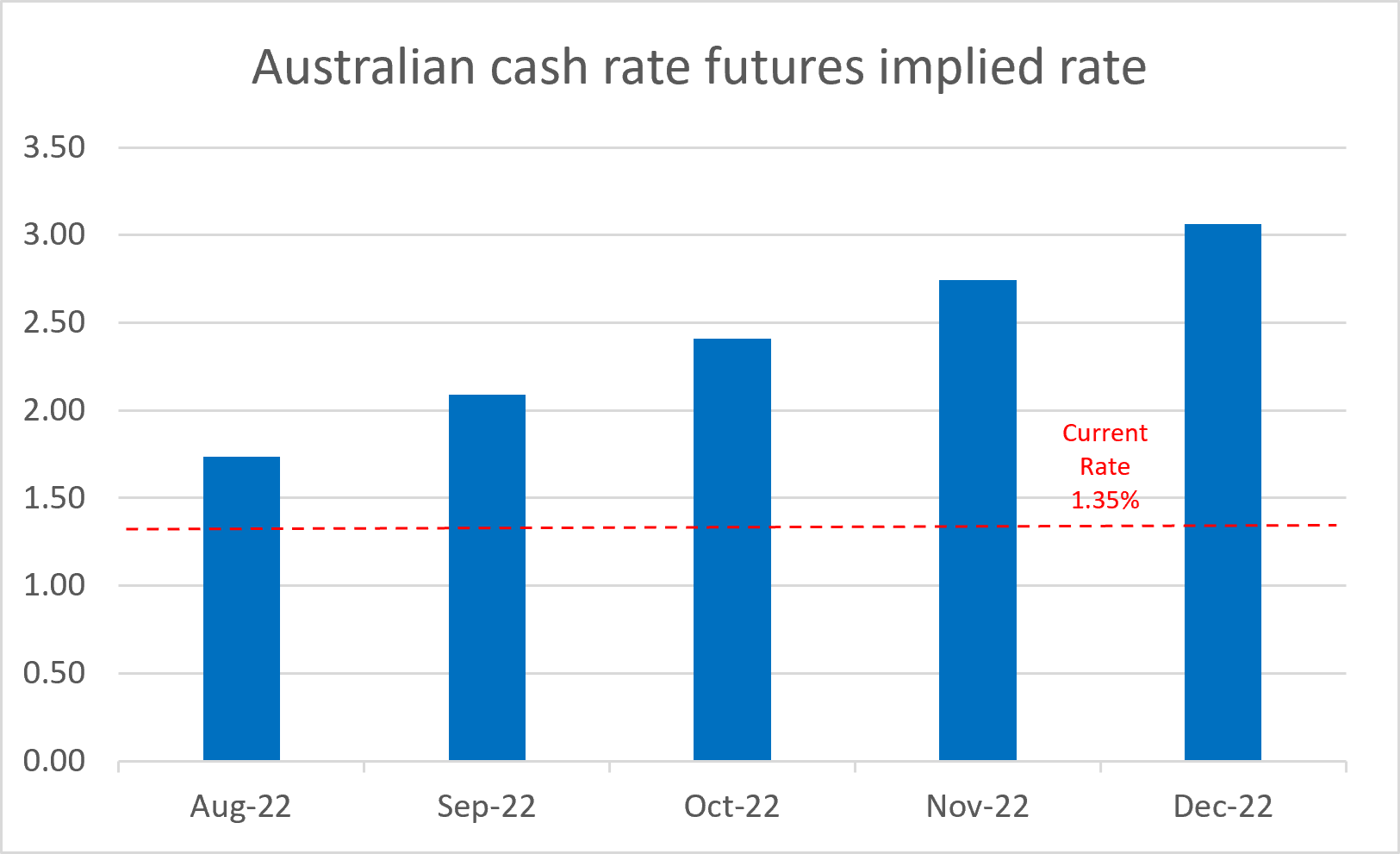

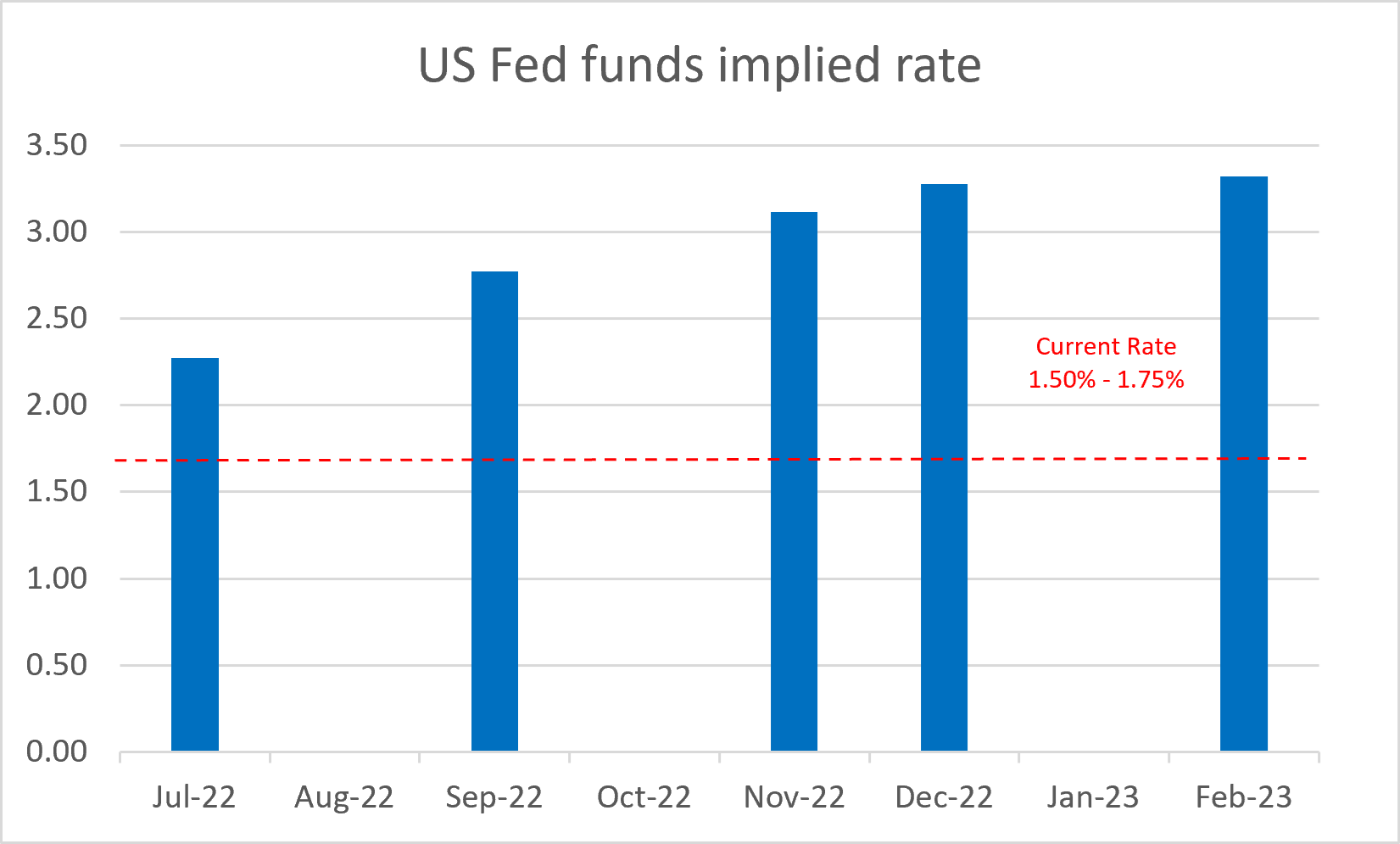

Of course, the message can change over time, but futures markets are currently forecasting a 170bps increase in US and Australian rates by December.

Source: Bloomberg

Source: Bloomberg

It’s often said the central banks will keep pushing until something breaks. The only way interest rates will not follow that trajectory is if US summer economic data is so weak that a pause in hikes is considered, which is becoming more likely by year’s end.

The risk for markets

If the futures markets are correct, homeowners will see a significant increase in mortgage repayments by December. The RBA’s 50bp rate rise in June woke many people up, and the domestic housing market is already coming under pressure.

The biggest risk for markets is whether the US enters a recession. If it does, S&P500 could fall another 15% – which would have an impact on Australia. If not, the falls will be more modest.

In the global economy, wage pressure continues to build as the consumer is squeezed by higher costs of everything, from rents to fuel. We believe high debt levels make the global and Australian economy particularly vulnerable.

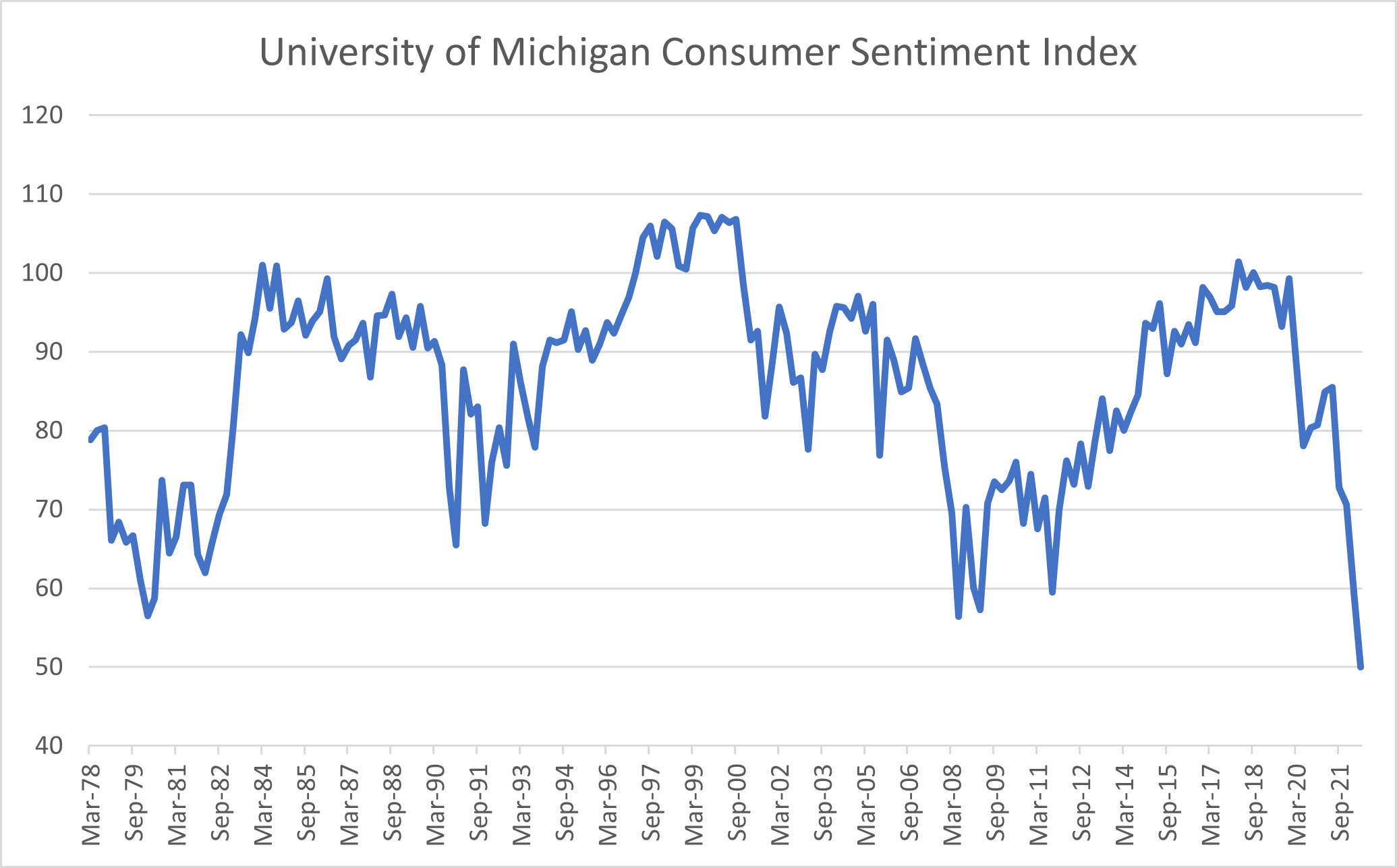

The current level of inflation likely also explains why consumer confidence is falling, and it’s pushed the University of Michigan index just below record lows. Consumer confidence is a key driver of consumer consumption, which drives around 70% of the US GDP.

Source: Bloomberg

Heading for recession?

Every recession in the past 40 years has been preceded by an inverted yield curve, and the yield curve inverted in early April. Looking historically, the time interval between inversion and recession averages about 10 to 12 months.

The US Fed needs to slow demand and can only do so by delivering “shock therapy” – by impacting consumers’ wealth (via stocks and house prices). The Fed will take every rate rise the market gives it, but at the end of the day raising rates is a blunt instrument.

It’s rare for central banks to engineer soft landings, particularly when inflation is above 5%. So, we believe the US is headed for a recession. This view runs somewhat counter to consensus. Until recently, most US economists had been suggesting there were no signs of a slowdown in US economic data, but the stock market indicates otherwise.

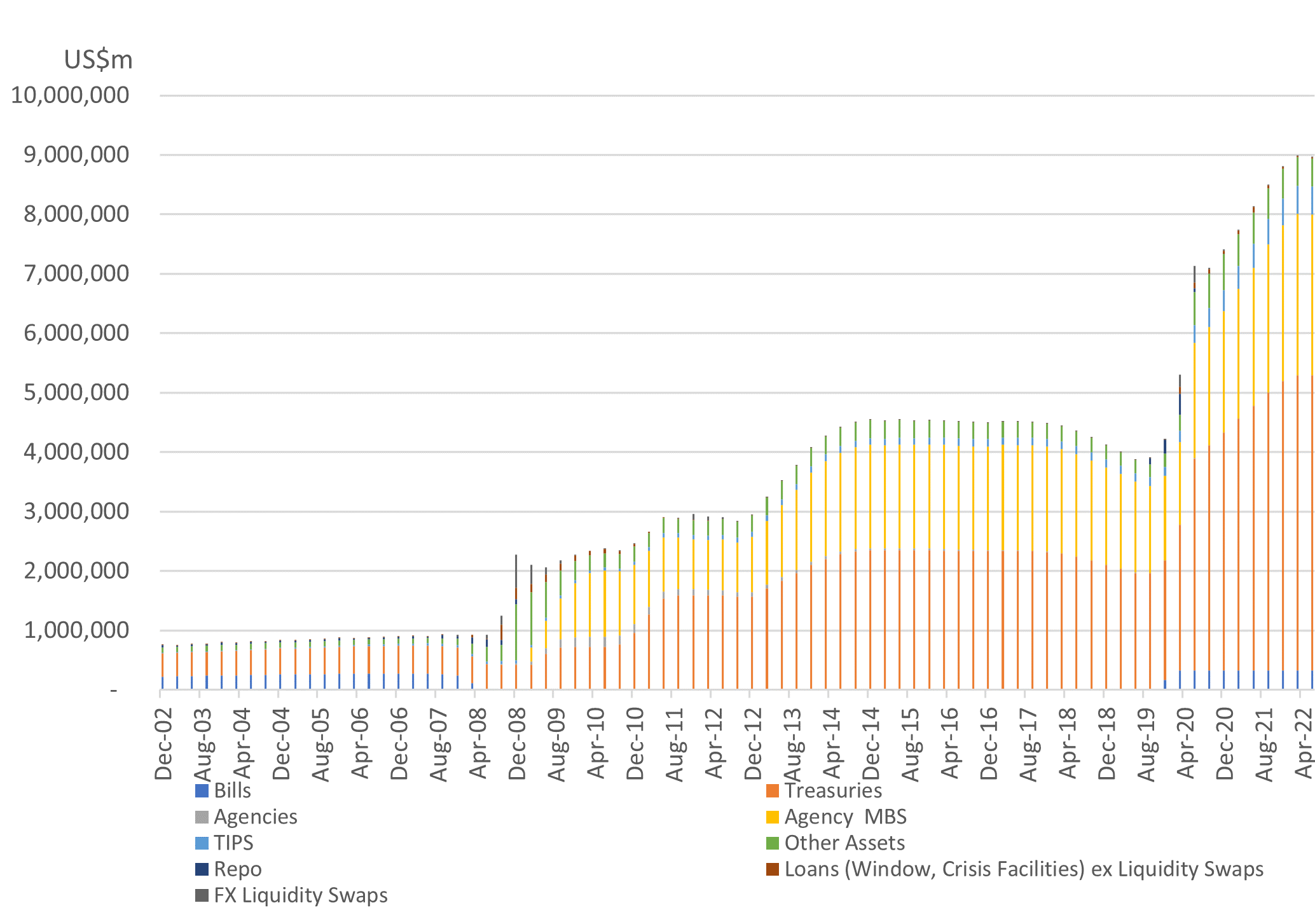

There’s also, of course, an unwind of the central bank’s balance sheet, which started this month in the US. The expansion of central bank balance sheets has inflated share prices in multiples since the GFC. It stands to reason that the opposite is also true. Federal Reserve Chair Jerome Powell’s mandate is to tame inflation.

We’re very early along the tightening journey – we’ve only had three interest rates rises so far, and the pain may be ahead of us more so than behind us. Although, it’s way too early in the rate hiking cycle to think about fighting central banks.

Source: Bloomberg

Our outlook

We’re long some defensive businesses, including Bapcor, Tabcorp and The Lottery Corporation. Auto parts are generally essential for car maintenance, while lottery tickets have proven to be very defensive during recessions.

The market wants current earnings, not future long-dated earnings, and certainly not loss makers. Loss makers have no valuation support and 17% of ASX300 are loss makers (even if some are temporary like FLT, WEB). Some don’t even have any significant revenue. This basket is where we are hunting for short ideas.

We’re short high multiple stocks – those with long earnings duration and loss makers. Of course, a constant risk for us is “bear market rallies” – these can be violent, so we’re cautious of being too aggressive in our short book.

We haven’t seen the capitulation yet. It is worth noting Cathie Wood’s beaten-down ARK Invest is still seeing inflows, even though ARK is off c.60%. This shows investors are still looking to buy the dips. The MSCI AC World 12m forward PE has derated from a peak 20x to 14x. However, global equity markets do not yet look especially cheap against history. For example, a drop to the 10x multiple seen during the 2011-12 Eurozone crisis would imply another ~30% derating.

We’ll be watching the economic data closely, with a particular focus on inflation, bond yields and whether central banks are forced to pause their tightening due to economic damage.

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.