The COVID-19 virus has had a devastating impact around the world. More than 2.5 million people have died, including more than 500,000 in the US, more than 120,000 in the UK, and 909 in Australia. The Institute of International Finance estimates that government support packages and other measures to combat the pandemic have added $24 trillion to global debt over the past year.

However, we believe an end to the pandemic is in sight. Several vaccine candidates have reported positive phase 3 trial results, including Pfizer, Moderna and AstraZeneca. These vaccines are now being rolled out across the globe, with (at the time of writing) more than 271 million doses administered across 108 countries, which now exceeds the 115 million confirmed COVID-19 cases globally.

The race for herd immunity

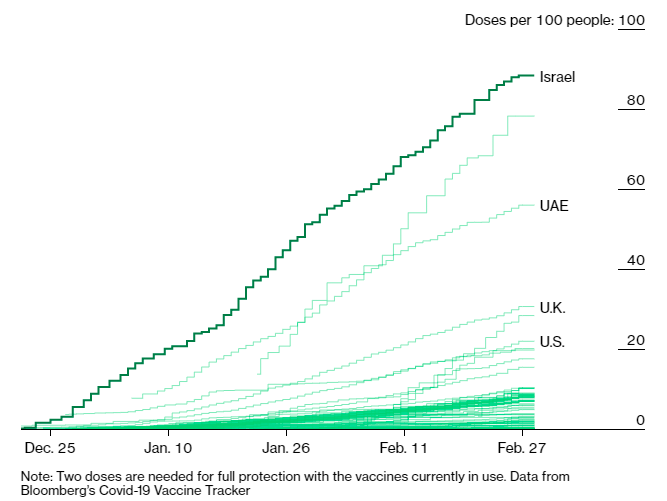

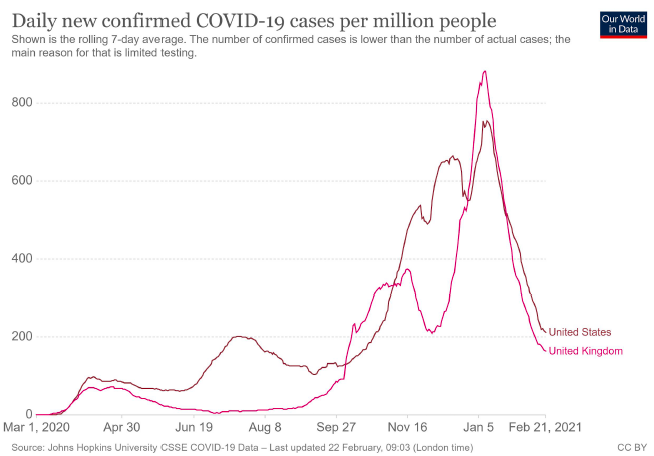

The speed of the rollout since the first dose was given in December is impressive, but with a global population of 7.8 billion – and estimates by US Chief Medical Adviser Dr Anthony Fauci that 70-90% of the global population needs to be immunised before the world achieves herd immunity – there is clearly a long way to go. In this regard, some countries are doing better than others with the vaccination rollout. Israel is leading the charge, with 53% of the population having had one dose and 39% having had the second dose. By comparison, 16% of the US population, 32% of the UK population and a miserly 5% of the EU population has had the first dose. Australia’s rollout of the Pfizer vaccine has just begun, with the first dose administered to around 61,000 people – largely quarantine and border workers, frontline healthcare workers and aged care residents and staff.

We are closely following events in Israel, and the signs are promising. Israel’s health ministry recently announced a real-world study in the country that showed the Pfizer vaccine was 98.9% effective at preventing COVID-19 deaths and 99.2% effective at preventing serious symptoms developing. Case numbers in the US and UK are also falling.

Australia is targeting 13 million vaccinations by mid-year, with the country fully vaccinated by October 2021. Flight Centre believes it is possible that low risk international travel could resume in the second half of 2021. Qantas expects to be at 60% of pre-COVID domestic capacity by Q3 this year, and 80% by Q4.

Not everyone is as pessimistic as Dr Anthony Fauci around the timing of herd immunity, with McKinsey estimating it could be achieved in the US and UK in the second half of 2021.

We share that optimism, and stocks that benefit from a re- opening scenario dominate our portfolio. Key holdings currently include Flight Centre, Pointsbet, Vicinity Centres, Virgin Money UK and Xero.

Up goes the yield curve

While we expect the world to move into a recovery phase, the astonishing level of debt left in the aftermath of the COVID- 19 pandemic is presenting real challenges for global governments. Quite possibly the only realistic policy outcome is a long period of above normal inflation (2.5%), which inflates away the world’s debt. Eventually, a prolonged period of inflation may be the least painful way of dealing with future debt costs.

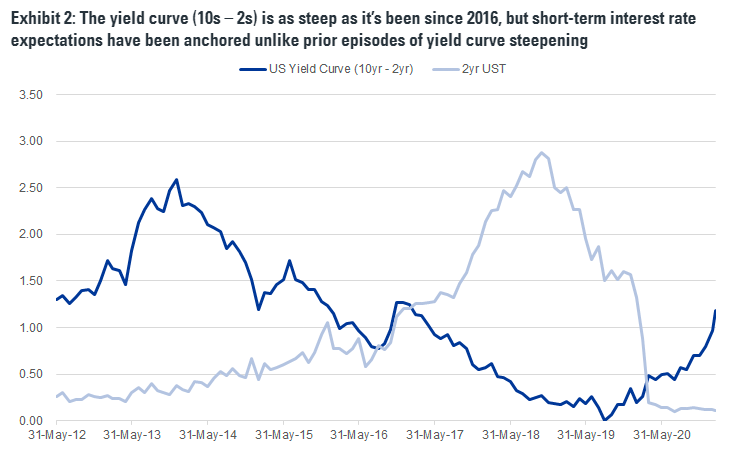

The US Federal Reserve is on record stating that it will hold rates low until full employment is reached and the rate of inflation exceeds the 2% target for some time. Should the Fed hold this line while growth and inflation expectations accelerate, the yield curve (10-year bonds less 2-year bonds) will likely steepen further than it already has. Most of 2021’s Treasury asset purchases are being done on the short end of the curve. With the short end of the curve suppressed and the long end of the curve rising, the curve will steepen.

History suggests Price to Earnings multiples will contract when the yield curve steepens and inflation moves above 2.5%. Of course the present value of cashflows discounted at 2% is much higher than those discounted by 4%, but it’s not always clear what changes in forward rates mean for asset valuations.

Goldman Sachs has identified three periods in recent history where the curve steepened dramatically, but in each case a sell-off in stocks was not sustained. 2013 saw the most dramatic steepening in the yield curve, which widened to 2.5% (versus the current 1.5%); however, the market still managed to achieve strong returns with growth stocks still outperforming value. While returns in 2015 were mixed, 2016 also generated strong returns.

Source: Goldman Sachs Research, FactSet

So now is not the time to throw the baby out of the bathtub..

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.