When speaking to clients, our investment team is frequently asked whether the market’s extraordinary run is due to come to an end. It’s a question many in the market are currently grappling with, and it pays to look back into history to provide a guide.

History repeating itself

In 2009, we saw only 5 drawdowns greater than 5% over the 18 months following the market’s low on 6 March 2009. Surprisingly the average drawdown was just above 4%, with each drawdown lasting on average just 7 trading days.

Despite seeming counter-intuitive given apparent risks, it isn’t unusual for markets to recover in this fashion after a large shock. History repeated following the recent COVID-induced drawdown, with only 2 drawdowns greater than 5% since the market bottomed on 23 March 2020, and each drawdown averaging only 3 trading days.

Today we find ourselves 15 months past the pandemic bottom in markets, with the ASX300 Accumulation Index having risen in 14 months out of the 15, and up a total of 67.8%. The market is 7.1% above its all-time high, and continues to climb higher.

Watching the signs

We remain positive on the market over the next 6 weeks as we head into a strong reporting season. However, a number of potential issues are accumulating as we enter the seasonally weaker period into September, with bond markets, options markets and the Chinese economy all attracting our attention.

Bond markets

The US Federal Reserve is committed to keeping its foot firmly on the accelerator until either employment numbers fall dramatically, or inflation accelerates to uncomfortable levels.

US headline inflation numbers released this week unexpectedly accelerated to 5.4% year on year in June, the biggest rise since 2008. One data point certainly does not make a trend; but three data points in a row is hard to dismiss, particularly when price pressures were so broad- based. Yet inflation is still transitory according to central bankers, and any acknowledgement otherwise is still months away.

Increasing inflation fears continue to spook investors that central banks may move sooner rather than later to lift interest rates, which saw the US 10-year bond yield rise from 0.50% in August 2020 to 1.74% in March 2021. But the yield has since retraced to 1.47% as the bond market warns of a potential economic slowdown. After experiencing a sell-off, since the middle of May investors have rotated once again into the tech sector, fuelled by the bond yield fall. Market breadth is narrowing (rarely a sign of market health), with mega-cap tech shares in the US increasingly taking leadership.

Options markets

The options market offers interesting insights, with positioning suggesting nearly everyone in the market is bullish. Implied volatility remains subdued, with the current put:call ratio extremely low – reflecting a heavy skew towards upside participation with little downside protection. ‘Who cares about protection’ seems to be the belief of the times. When the deck is stacked heavily towards upside participation, investors can aggressively move en masse to downside protection when markets do fall – leading to an even sharper reversal.

China

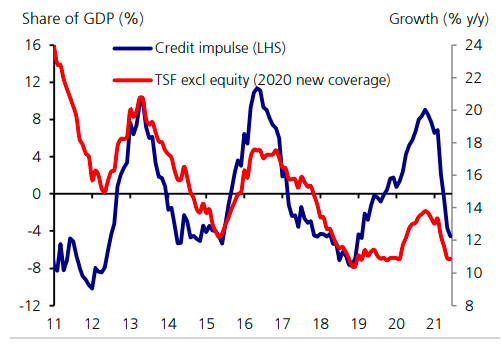

Meanwhile, the Chinese economy is at an interesting juncture. Having led the world out of the COVID-induced economic downturn, several indicators suggest risks are rising. Total social financing, which is a broad measure of credit and liquidity in the economy, has been falling after the Chinese government embarked on a process of deleveraging, allowing the economy to move forward with less stimulus support.

Source: CEIC, UBS estimates

The Chinese approach is in contrast to that of the US, which continues to provide significant monetary and fiscal stimulus. Other Chinese data has also been weak recently, including the Caixin composite PMI which fell from 53.8 in May to 50.6 in June (the lowest reading since April 2020). New orders are at a 14-month low. The People’s Bank of China has recently cut the Required Reserve Ratio (RRR) by 50bp, releasing an estimated RMB 1 trillion in base money liquidity and reducing bank funding costs by RMB 13b per annum. This should assist bank liquidity; however, we do not believe it represents a change in monetary policy by the Chinese authorities, with tighter prudential regulations and a continued slowdown in credit growth likely.

Alan Greenspan famously said in 1973: “It’s very rare that you can be as unqualifiedly bullish as you can now.” These words were spoken just before two of the worst years for the US economy and the stock market. Could the Australian market be heading for a similar comeuppance?

1 Includes all drawdowns in the ASX300AI greater than 2% between 6 March 2009 and 31 December 2010

1 Includes all drawdowns in the ASX300AI greater than 2% between 23 March 2020 and 13 July 2021

1 As at 30 June 2021

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.