One of the things that differentiates the Kardinia Absolute Return Fund from long only funds is its ability to generate a return or hedge the portfolio by short selling stocks.

Short sellers are often criticised for preying on the weak and taking advantage of misfortune. Napoleon is said to have called them ‘enemies of the state’. Whenever the market falls sharply, it is short sellers who often come in for criticism, with calls for increased regulation or a banning of the practice.

Contrary to some opinions, however, we don’t operate in packs and short well-run businesses. Instead, we tend to look for poorly-run businesses whose management teams often resort to accounting tricks to give an overly optimistic assessment of their business.

What is short selling?

Anyone with a cursory interest in the share market has heard of short sellers, but many don’t really understand how it works. Let’s start with a simple example.

Imagine for a moment you are a farmer. You don’t own any sheep, and you believe they’re overpriced. So you look over the fence and ask your neighbour if you can borrow their sheep and pay them interest over the holding period. Since sheep are broadly homogeneous, your neighbour is happy to do so as long as the correct number of sheep are returned when requested.

Off you go to market to sell the sheep for $100. Your instinct about the price was correct, and the price per sheep subsequently falls to $65. You buy the sheep back at the lower price, return them to the neighbour and profit $35. Borrowing something which is not yours, taking it to the market, and selling it with the belief you can buy it back cheaper – that’s shorting.

Once we’ve made a decision to short a company, we contact a broker to borrow the shares. We make sure the borrowing costs aren’t prohibitive and then sell the shares on market like any other sale. The stock is monitored like any other stock in our portfolio. Once the trade has played out we purchase the shorted shares and return the stock we bought to the lender and stop paying the borrow fee.

What makes a good short?

We approach our short book exactly the same way as our long book. The only difference between us and a long only manager is that when analysing a company and discovering too many red flags, a long only manager will place their pen down; but we can continue to work and then make money off the idea by going ‘short’ the stock.

When it comes to shorting, we’re looking for as many of the following ‘loser attributes’ as possible.

- Weak balance sheet

- Poor earnings quality/cash flows

- Low returns

- Small potential market

- Industry headwinds

It’s a difficult business, and you’re fighting against many factors. Markets tend to go up, broking houses tend to publish supportive research, management are always talking up their stories – so you need a healthy serve of patience to see the investment thesis play out.

One of our most successful shorts has been our position in Bendigo Bank. With a weak capital position, we believed a raising was highly likely, resulting in a further dilution to earnings – which we eventually saw in February 2020. Earnings quality has been consistently poor, with a heavy reliance on Homesafe given the reliance on revaluations to drive profits (home owners sell a share of the future sale value of their homes). Returns remain bottom quartile as the company battles to restructure the underlying business, with heavy spending through to 2022 growing to $80m. Its cost outcome continues to be flattered by capitalised software charges that continue to run in excess of amortisation. Dividends have recently been cut, revenue downgraded and costs blown out.

The competitive advantage from shorting experience

One of the side benefits of shorting is that we find the knowledge and experience gained from shorting poor-quality businesses provides us with a competitive advantage when it comes to picking stocks for our long book. We’re aware of the short positioning in a stock, the availability of borrow, the cost of that borrow and other factors involved in shorting a stock, which provides valuable market intelligence with respect to market positioning in a stock and helps us to identify heavily shorted stocks, or ‘crowded shorts’.

When a stock is heavily shorted and reports reasonable news, there are few headwinds to the stock moving higher, as market participants are unable to short any more stock and often buy the stock on market to cover their short position. We take advantage of this knowledge when we have a more bullish assessment of a company’s prospects, particularly during reporting season when crowded shorts can rally significantly (‘short squeeze’) – even on a poor result.

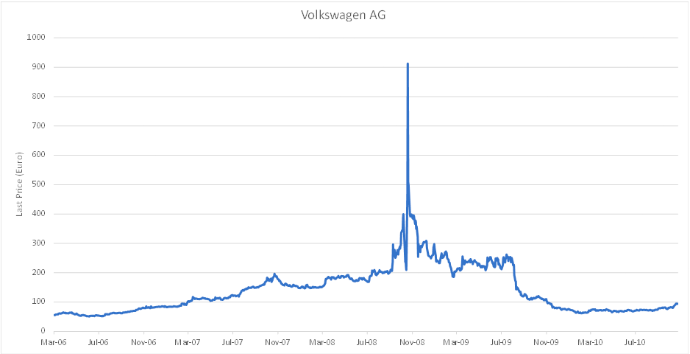

One of the biggest short squeezes of all time occurred during the attempted takeover of Volkswagen by Porsche in 2008, when the share price of Volkswagen skyrocketed 400% in the space of two trading days – from €200 to €1000.

In March 2008, Porsche owned 31% of Volkswagen. Hedge funds had shorted Volkswagen partially due to concerns over auto demand during the GFC. But in October 2008 Porsche announced it had increased its stake in Volkswagen to 43% and it owned call options over a further 31% of Volkswagen shares – giving Porsche an effective interest in the company of 74%.

At that time, around 12% of the issued shares in Volkswagen were net short. Normally when a company is in play, short sellers need to buy shares on market to deliver back to the entity who lent them the shares in the first place. The issue for the short sellers in this case was the company’s share register: Porsche controlled 74% of the shares and Lower Saxony owned 20%, and neither were sellers. What followed was an aggressive short squeeze as shorters covered their positions by pushing the share price ever higher. In doing so, the shorters briefly made Volkswagen the biggest company in the world, with a market capitalisation of more than $350 billion. In the end, Porsche failed to stump up the cash to exercise the options, and was itself bailed out by none other than – Volkswagen.

Making the shorts work

While a takeover of a short position is always a risk, we at Kardinia minimise this risk by taking smaller position sizes in our short book and utilising its market intelligence with respect to market positioning of all short positions. Some of the most heavily shorted stocks currently in the Australian market include Webjet, Z1P Co and Pro Medicus.

We also try to avoid shorting companies that have assets that might be attractive to an acquirer. Break-up valuations take on more prominence in our investment process when analysing potential short positions – meaning we typically avoid a Porsche/Volkswagen scenario.

At Kardinia, the short book has been a consistent positive contributor to our strategy’s performance since its inception 14 years ago. In the COVID-induced market drawdown of February/March 2020, the short book made a significant positive contribution to performance and helped ensure that we protected investors’ capital (Kardinia -3.93%, market – 36.17%)*.

* Full performance history is available on our website

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.