Just as the Australian Census promises to provide a comprehensive snapshot of the country and how we are changing, so too the recently- complete Australian profit reporting season can tell us what life has been like for Australians over the past 12 months.

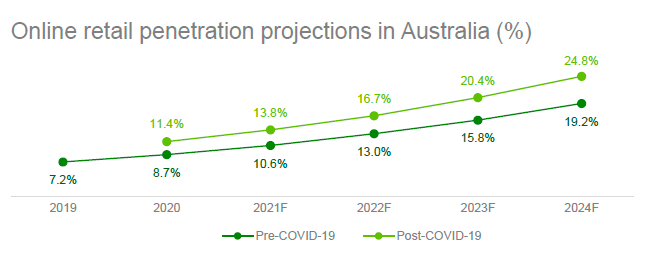

Growth of online sales

With so many Australians stuck behind their computer screen during the day, it is no surprise that they have been spending online with a vengeance, fast-tracking the structural move from bricks and mortar to online shopping. The CEO of Australian online book seller Booktopia stated “the pandemic was a massive bump for people buying online … online retail in FY21 was 13% of all retail. In three years by FY24 online retail will be 24% of all retail, almost double”1 .

Source: Booktopia FY21 Results Presentation

Australian online home furnishing retailer Temple and Webster (TPW) is another such example, where FY21 revenue is up 85% on prior calendar period. We also got a glimpse of current trading, with July month to date revenue growth accelerated to +39%. We expect TPW to report a tremendous uplift in gross profit, enabling significant reinvestment in FY22.

Savings rate still elevated

The savings rate among Australians has fallen, but remains at elevated levels (at ~12% of disposable income). Reporting season saw a record in dividends declared, with over $40bn of dividends to be paid: almost double that paid in the same period last year. Most of these dividends will be paid in September and October. Consumers’ banks balances will swell as a result of these record dividends as well as buybacks and the proceeds from a record year of M&A deals.

Retail will remain a beneficiary, as will the share market (given a significant amount of this cash will undoubtedly be recycled back into Australian equities). FY21 has seen some of the biggest deals in Australian history with Square’s takeover bid for Afterpay, BHP Petroleum’s proposed merger with Woodside Petroleum, MIRA/Aware Super’s acquisition of Vocus, Seven Group’s partial takeover of Boral and the bid for Sydney Airport by a consortium of super funds.

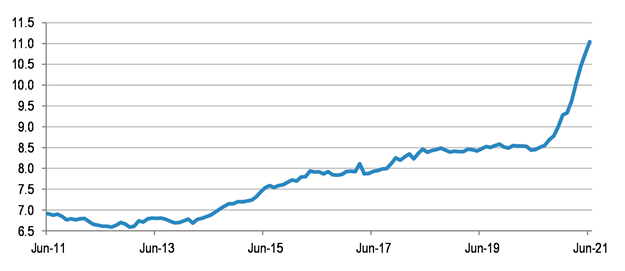

Internet data usage swelling

Many Australians no longer find themselves catching the train to work in the city. Instead, government-imposed COVID restrictions mean they are housebound, working from home and juggling the demands of home learning for schoolchildren. For this, they need a fast and reliable internet connection – and as a result, demand for high speed broadband has gone through the roof. Uniti Group’s share price increased by 133% for the year, with “work-lifestyle changes making fibre networks an essential commodity” 2 . Aussie Broadband (ABB) has seen revenue growth of more than 80% from its residential and business customers.

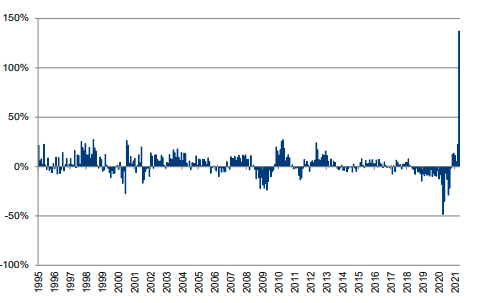

Solid demand for cars

While at home, people are getting onto jobs that usually take a back seat, such as renovating the house or upgrading the family car. Based on VFacts, the Australian new vehicle market grew +38% over Jan-May 2021. Strong demand, reduced discounting and a normalisation of parts and servicing demand has contributed to explosive car dealers’ results.

We have seen very strong profit results and growing forward order books from dealers like Eagers Automotive (APE) and Autosports (ASG) – both companies’ share prices have appreciated over the previous 12 months, at 145% and 118% respectively. APE’s “order bank growth is expected to continue as new vehicle demand remains strong and vehicle supply remains constrained”3.

Historical national new car sales volumes

Source: Morgans, ABS

Renovation explosion

Further to the above, Australians are building and renovating their homes with vigour, driven in large part by support from the Federal Government’s Homebuilder program. James Hardie’s Asian Pacific region’s sales growth increased 55% in the three months to the end of June. As an aside, the US restore and restoration market also grew at around 15% in the previous quarter.

Bluescope’s Australian Steel Products division, where around a third of product goes to the Dwellings segment, reported the “strongest domestic despatches since 2H FY2008, driven by record demand across both residential and non-residential construction segments … homebound consumers continued with trend of redirecting discretionary funds to renovations”4.

Alterations and additions – value of approvals (MAT, A$b)

Weak travel results

This spending around the home has come at the obvious expense of travel, with significant losses reported by the listed travel companies (Qantas $1.8b loss, Flight Centre $507m loss, Corporate Travel $33m loss). It’s refreshing to hear from a CEO who states it as it is, and Rex was perhaps the most direct of the airlines with its outlook statement, saying “the second half will still be struck by further waves of infection given the experience of other highly vaccinated countries. As such the outlook for the FY is pessimistic.” 5

It’s not for lack of trying. Australians are ready to travel. Qantas Chief Customer Officer, Stephanie Tully, commented: “So we [have] obviously been researching our customers throughout the pandemic on their desire to travel and doing that monthly and in the last couple of months, particularly for international, we’ve seen the highest demand levels we’ve ever seen. When you compare that to pre-pandemic levels of people that are likely to travel in the next 12 months, we’re seeing triple the amount of people looking to travel internationally in the next 12 months.” 6

Aircraft are being pulled out of storage, including the A380s, and reconfigurations are currently underway with the intention to return to the skies when the magical 70% and then 80% vaccination rates are achieved. Bolstering management’s confidence was the strength of the domestic business in the June quarter of FY21 – by the end of June, management basically saw the domestic business booking curves back to pre-COVID levels.

Concerning inventory levels

Arguably the number one theme of reporting season has been online retailers ending up with too much inventory.

Everyone seems to want to ‘invest’ in inventory as a strategic play. A stretched global manufacturing and supply chain is creating challenges – including longer lead times, higher freight costs and shipping delays – leading to companies growing inventory levels. Supercheap Retail (SUL) management said: “If it’s [inventory is] not in the shed or on the shelf today, for Christmas this year I think the chance of it being [in stock] come that peak time is incredibly remote.”7

However, we do not want inventory growth outstripping sales growth, and this is something we’ll watching closely in future periods. Retailers (BRG, SUL, KGN) continue to show higher levels of inventory and it’s concerning us. Only JBH and BBN have managed to keep inventory days down so far. Whether customers will be the major beneficiaries of heightened promotion activity (for inventory vulnerable to obsolescence such as technology) remains unknown; only time will tell.

What does all this mean for the future?

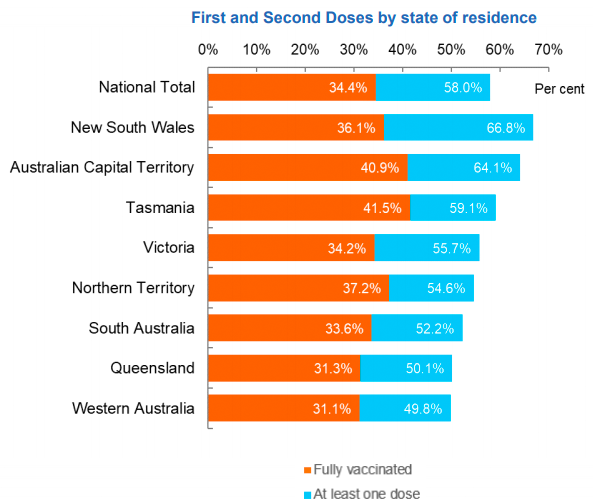

With COVID vaccinations accelerating across the country, we believe Australians can look forward to a happier 2022; with blunt lockdowns less likely, and more targeted measures introduced when COVID hospitalisations or deaths spike. At the time of writing, ~60% of Australians over the age of 16 have received one dose of vaccine while ~35% have received two doses. Globally, more than 5 billion doses have been given.

Source: Australian Government, Department of Health

We predict the 70% threshold for vaccinations will be reached by the end of October, which will be around the same time as AGM season. Our view is CEOs will start to get more optimistic around this event. This is likely going to continue the rotation towards coronavirus-impacted sectors.

The Kardinia portfolio is positioned for re-opening, with stocks that benefit from this comprising ~30% of the long book and lockdown stocks only ~10%. We believe some themes, such as the shift to online, are enduring, and we continue to hold exposure to the technology sector. Of course, new COVID variants and government nervousness around a likely rising death rate (as witnessed overseas) present risks to our view, but the Kardinia fund’s ability to shift its net exposure to markets in a range of -25% to +75% allows us to quickly respond to any change in outlook.

1 Booktopia FY21 Results Presentation 2 Uniti Group FY21 Results Presentation 3 Eagers Automotive FY21 Results Presentation 4 Bluescope FY21 Results Presentation 5 Rex FY21 Results Presentation 6 Qantas FY21 Earnings Call 7 ‘Zero chances of it arriving on time’, Sydney Morning Herald, 22 August 2021

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Kardinia Long Short Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This publication has been prepared by Kardinia Capital Pty Ltd to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Kardinia Capital Pty Ltd, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.